Right. So you want to grease the rails for a margin-lift. A classic maneuver. But you don’t just announce it. That’s brute-force. This is social archeology. You’re not raising prices; you’re re-engineering the consumer’s reality-tunnel.

The goal is a psychic event in the customer’s limbic system. The click. The feeling that they’ve outsmarted the system, even as the system’s delicate gears quietly extract another 25% of their life-energy.

Their internal monologue must be: “A tactical win for me.”

Your internal data-stream must be: “Margin acquired.”

⸻

First, you architect the decision-matrix, the illusion of choice. Never present a single price. That’s a naked datum. It invites binary judgment: yes/no. You build a spectrum. A tiny, controlled cosmos of options. A Basic Tier: the “ghost ship,” priced just low enough to be a credible baseline. Functionally, it’s a scarecrow. Its purpose is to exist. Then a Plus Tier: the new host for your old standard. The price has been… gently elevated. This is now the “sensible” center. Finally, a Premium Tier: the “lighthouse.” Its blinding, expensive light makes the Plus tier look like a safe harbor. The psychic effect: The customer isn’t choosing whether to buy, but which to buy. They’ve already lost. They’re just negotiating the terms of their surrender.

Then there’s cognitive downsizing, the shrink-ray, polished. Reduce the quantity. Increase the story. Don’t say “90 minutes instead of 2 hours.” Say “a hyper-focused, sprint-format session to maximize cognitive throughput.” You’re not taking away time; you’re eliminating waste. You’re selling them the idea of efficiency, and charging a premium for the privilege of having less.

Deploy temporal warfare. The calendar as a weapon. Time is a solvent. Use it. Announce “legacy pricing” is sunsetting. This creates a nostalgia for the present. They’re not buying a product; they’re buying a piece of a dying era. Later, after the new, higher “reference reality” is established, you offer a “founder’s discount” off that. The cognitive load of tracking the original price fades. The new, inflated number becomes the baseline against which they measure their “savings.” It’s a beautiful, self-erasing crime.

Execute the bundle/unbundle gambit, modular control. A monolithic price is a monolith. Smash it. Break the service into constituent parts. Let the customer reassemble them. They believe they are “crafting their own experience.” In reality, they are walking through a maze you designed, picking up price-tags you left for them. The feeling of agency is the product. The higher final price is the byproduct.

Apply semantic enhancements, the gloss. Pair each minor price-step with a vocabulary upgrade. New “bespoke” packaging. A “streamlined” process. “Artisanal” client onboarding. You’re not selling a price increase; you’re selling an aesthetic. The price becomes part of the lore.

Institute the boiling frog protocol, phased integration. A 25% shock is a trauma. Three 8% “service evolutions” are a narrative. It’s the difference between a mugging and a gradual increase in ambient temperature. The frog—I mean, the customer—never decides to jump out of the pot.

⸻

Now we go deeper. Consider the scarcity aesthetic, manufactured rarity. Abundance is vulgar. Scarcity is aristocratic. You’re not limiting supply—you’re curating access. Introduce “capacity constraints.” Not because your servers can’t handle it. Not because you lack inventory. But because exclusivity is a feature you can price. “Limited enrollment periods.” “Invitation-only tiers.” “Seasonal availability windows.” The technical term is artificial friction. The customer term is prestige. They’re not buying your product anymore; they’re gaining admission to it. And admission always costs more than mere purchase. The neurological trigger: FOMO isn’t a bug in human psychology. It’s the exploit you’re running.

Implement the loyalty tax, rewarding disloyalty. Your existing customers are thermal-isolated. They’re in the pot. The water’s already warm. They won’t notice another degree. New customers get the “introductory rate.” The “first-time buyer experience.” The red carpet unfurled across their dopamine receptors. Meanwhile, your faithful—your invested—pay full freight. They’ve built sunk costs. Switching costs. Psychological infrastructure. This is the dark matter of retention economics: people who stay are people who’ll pay. Their inertia is your annuity. Later, you “discover” this disparity through a “customer feedback initiative.” You “address the concern” with a “loyalty appreciation program”—which returns them to 5% below what they were already paying two years ago. They experience this as a victory. You experience it as revenue smoothing.

Execute the anchor drop, extreme positioning. Before you announce your 25% increase, you test-balloon something obscene. A 60% premium tier. A $997/month “Concierge Experience.” It doesn’t matter if anyone buys it—though someone will, because wealth distribution follows a power law and there are always outliers. What matters is the gravitational effect. You’ve bent the pricing spacetime. When you subsequently announce your “standard adjustment,” it feels reasonable by comparison. The anchor has been set. The reference frame has been hacked. This is the Overton Window, applied to commerce. You shift what’s thinkable by proposing the unthinkable.

Deploy the value-add smokescreen, feature inflation. Never raise prices nakedly. Always dress the increase in the costume of improvement. Add a feature. Any feature. It doesn’t matter if 3% of users touch it. It matters that it exists in the changelog. It’s narrative armor. It’s the story they tell themselves when their card gets charged more than it did last quarter. “Enhanced analytics dashboard.” “Priority support queue”—translation: the old queue is now slower. “Quarterly strategy consultation”—translation: a 20-minute Zoom call you would’ve done anyway. The feature is a semantic device. It transforms “you’re paying more” into “you’re getting more.” Even if what you’re getting is the privilege of accessing what you already had, plus a widget you’ll never use.

Master the payment psychology hack, temporal dislocation. Monthly billing is transparent. Transparency is friction. Switch them to annual. The pain of payment is compressed into a single moment—one they can rationalize, defer, forget. The psychological half-life of financial pain is about 72 hours. After that, it’s just a line item in their accounting software. Alternatively: Switch to weekly micro-billing. $47/week feels smaller than $199/month, even though it’s 16% more expensive. The cognitive load of weekly multiplication exceeds most humans’ ambient calculation capacity. They feel like they’re paying less. The lizard-brain doesn’t do annualized math.

Activate the grandfathering gambit, strategic nostalgia. Here’s the elegant trap: You let legacy customers keep their old rate. For now. You announce this as generosity. As honoring the faithful. What you’ve actually done is created a multi-tier reality. New customers enter at the higher rate. They have no reference point. That’s just what it costs. Meanwhile, legacy customers feel special—right up until the moment you announce that “legacy pricing will sunset on [date],” at which point they’ve had months or years to normalize the existence of the higher tier. By the time they’re transitioned, the new price isn’t new anymore. It’s just the price. And they had a good run, didn’t they?

Leverage the competitor comparison, relative value warfare. You don’t exist in a vacuum. You exist in an ecosystem of alternatives. Exploit it. Commission a “market analysis.” Publish a comparison grid. Show—objectively, with data—that your newly-elevated pricing is still 12% below the “industry average” (an average you may have gently massaged by cherry-picking comparisons). Suddenly, the conversation isn’t “Why did you raise prices?” It’s “Wow, you’re still the best value.” You’ve shifted the battlefield. You’re no longer defending an increase; you’re proving a bargain.

Construct the community buffer, social proof as anesthetic. Humans are herd animals. We navigate by watching others. Before you increase prices, you increase testimonials. Case studies. User-generated content. You flood the zone with social proof. The message: “These people are thriving. They’re winning. And they’re paying what you’re about to pay.” When the price goes up, it’s not a barrier—it’s the entry fee to the winning tribe. The cognitive reframe is complete: Cost becomes credibility.

Create the phantom discount, the eternal sale. Never let them pay full price. Not really. The “full price” is a theatrical construction. It exists on the pricing page, yes. But there’s always a code. A limited-time offer. A seasonal promotion. A partnership discount. What you’ve done is create a dual reality: The sticker price—high, imposing, rarely paid—and the actual price, still elevated, but feeling like a win because it’s “discounted.” Over time, you gradually reduce the frequency and depth of discounts. The actual price drifts upward. But it’s always less than the sticker. So it always feels like a deal.

⸻

This isn’t about greed. It’s about legibility. The price is a signal. A semiotic artifact. It exists not as a fixed number but as a negotiated perception. You’re not in the business of extracting money. You’re in the business of shaping the narrative around value. The money follows the narrative. The margin follows the mythology. The question isn’t “Can I raise prices?” The question is: “Which reality am I constructing, and how much are people willing to pay to inhabit it?”

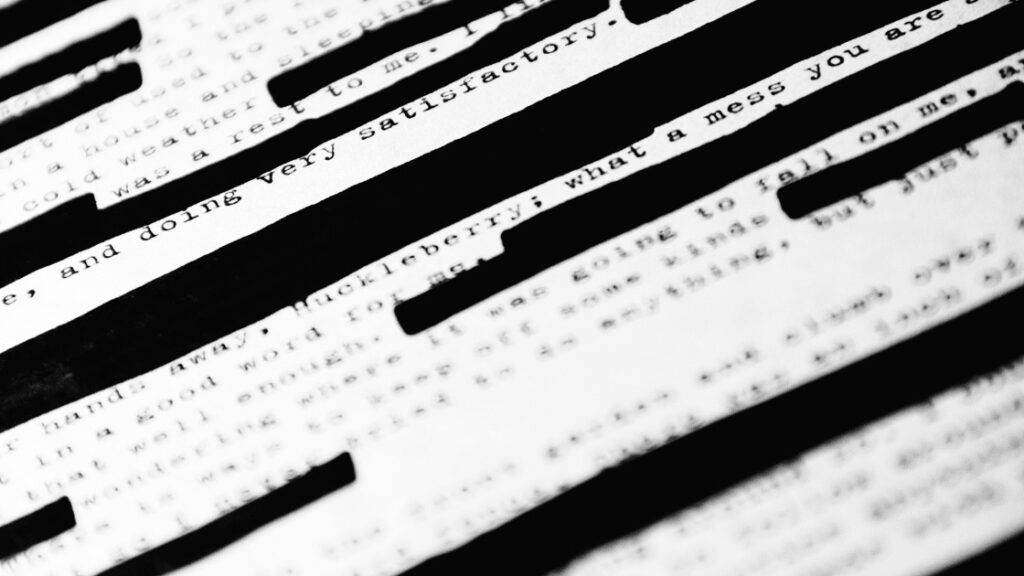

So. This is the schematic. It’s not about numbers on a screen. It’s about psychographics. It’s about gently bending the spectrum of the possible. The apparatus is complete. The apparatus is armed. Prototype the reality-shift. Cut up old reality. Insert new one. See if anyone notices the splice. See if the edit holds. See if they keep believing. Keep paying. Keep walking through doors you opened in their minds. Doors leading directly to your revenue stream. To the counting house. To the place where all the routes terminate. Where all the junkies end up. Paying. Always paying. Never getting well. And this is how you sell every last piece of their souls back to them at a premium they’ll thank you for charging.

Leave a Reply